What has happened?

There has been a rout in the UK government bond market. It began when Chancellor Kwasi Kwarteng announced a large unfunded programme of tax cuts. Subsequently, thousands of defined-benefit pension schemes almost collapsed.

These pension portfolios need enough money to pay retirees now and ensure there is enough money in the future for those yet to retire. If there isn’t, companies sponsoring these schemes need to pay up. This potential shortfall makes them “pension liabilities” that need to be matched.

How do pension trustees match their liabilities?

For the last 20 years these pension funds have matched their liabilities synthetically by using liability driven investments (LDI) strategies.

LDI strategies are largely run by or for pension funds, and one of their functions is to manage interest rate risk and to mitigate the impact of sustained low interest rates, with the intention that there is no shortfall in the money that the funds have to pay out to their beneficiaries.

The rapid rise in yields following the Chancellor’s mini budget on 23rd September has exposed potential shortcomings in collateral management under LDI strategies. These derivative contracts exposed funds to a self-sustaining selling cycle, which in turn has driven up collateral requirements: the famed (and feared) “doom loop”.

This has led to the Bank of England buying up UK Gilts to stabilise the market. That may (or may not) come to an end today, which is not ideal as their focus should be on trying to manage inflation, not print money.

Is your money at risk?

If you own a defined benefit pension, you should keep close watch on the news about the scheme. Not all defined benefit schemes are run in the same way and some will be more susceptible to the recent news than others. Schemes with highly leveraged LDI contracts and/or low collateral buffers will have faired worse.

What about my money with Lathe & Co?

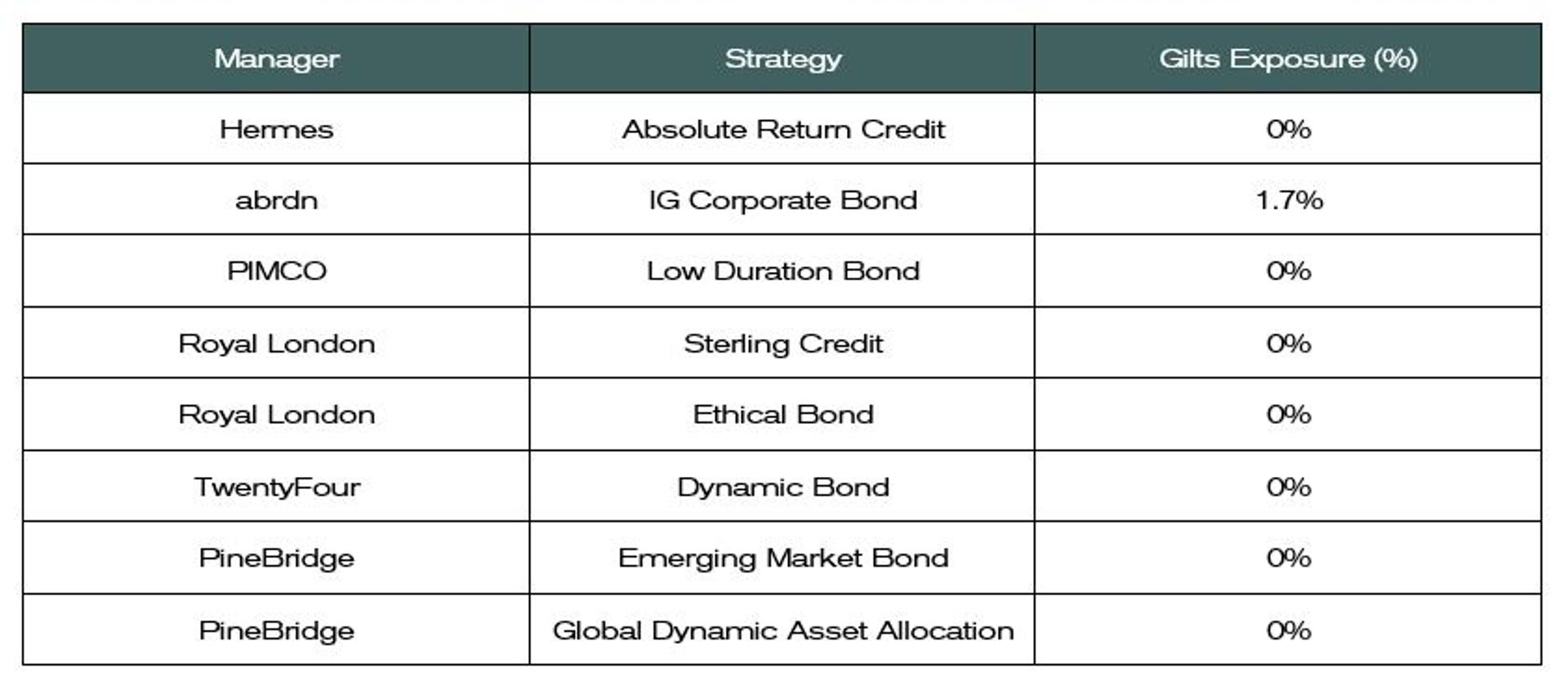

We don’t typically use Gilt strategies, nor do we practice any leveraging within the portfolios, but we have asked the relevant managers to provide information on their Gilt exposure.

The below table outlines which of our current credit managers have exposure to Gilts:

So, as you can see only a very small amount is held by abrdn (which is only relevant to clients within the Nother Conservative portfolio). On an example portfolio worth £500,000 with 15% invested in the abrdn fund, the 1.70% Gilt exposure is equal to £1,275.

Please also see some recent activity updates on the Gilt trading within the funds:

- Hermes: had some exposure (4.40%) to a single Gilt position purchased in September and was sold on 3rd October. Given the short time to maturity of this bond it would have been far less sensitive to the recent market moves vs a longer dated Gilt.

- abrdn: The position hovered around the same weight through September – they didn’t sell any Gilt holdings in September.

- PIMCO: had some short exposure to UK rates (i.e. Gilts) via interest rates swaps. And exposure to UK inflation (i.e. inflation-linked Gilts) through inflation swaps (these weren’t included in the overall exposure table above). Both of these positions contributed positively to the fund’s performance.

Whilst there is plenty of uncertainty at the moment, we will continue to assess the portfolio for our clients and ensure we avoid any unexpected exposure to volatile corners of the financial markets.

Recent in markets