Generally, the impact of war on financial markets is smaller than you might expect. US equities fell sharply at the start of the First World War but were up almost 40% when it ended. Similarly, in the Second World War, US stocks had returned over 76% by September 1945. More recent (and smaller) wars have also had a limited impact on markets.

Impact of war on stock markets in the 21st Century

In the 21st century alone, there have been several major wars, countless smaller regional conflicts, and a number of terror-related incidents. However, the impact on equities in developed markets has been fairly limited - even following dramatic shocks like Russia’s invasion of Ukraine and the ensuing energy crisis.

Middle East conflicts and the effect on oil prices

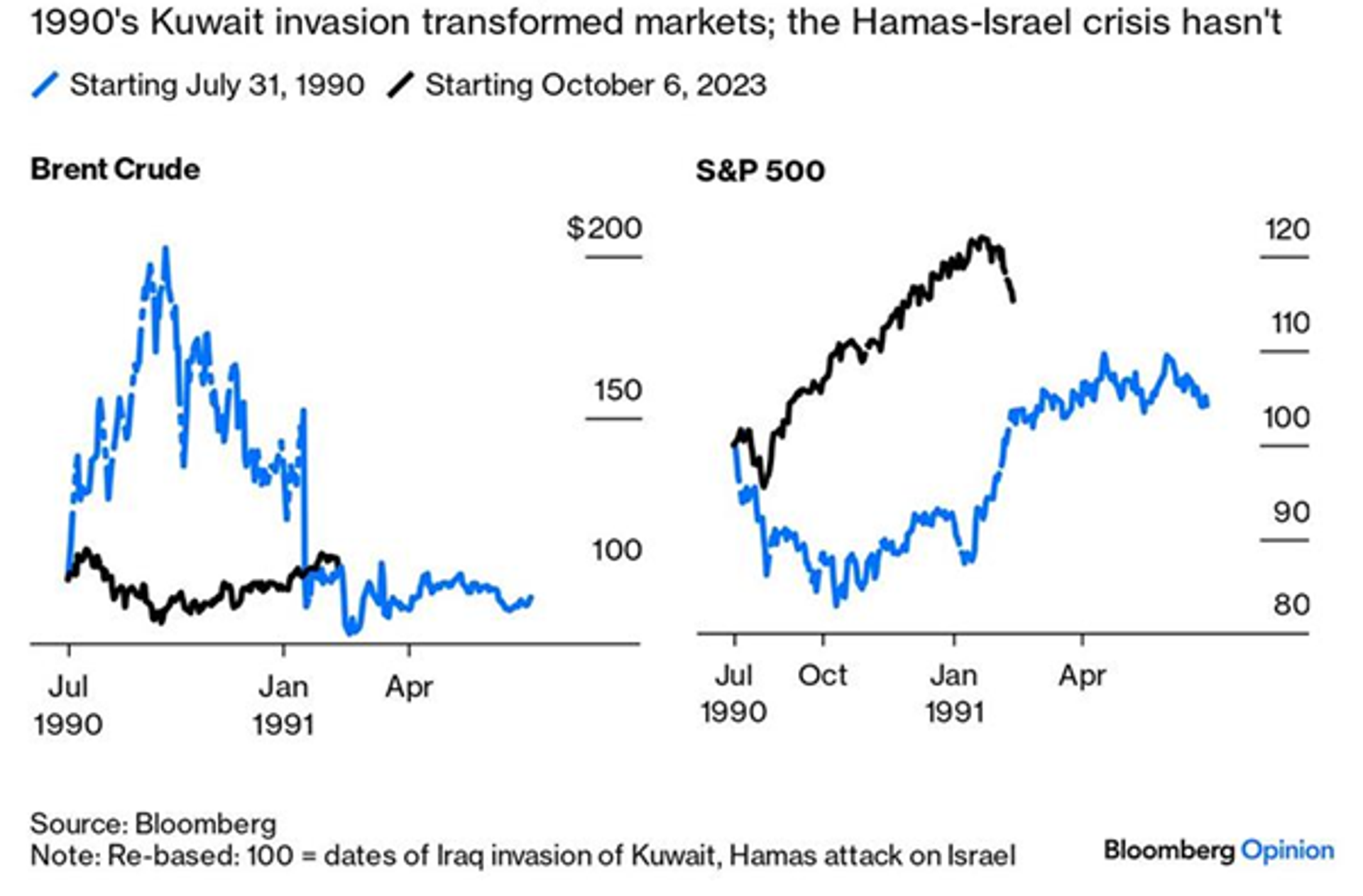

One of the major impacts of war in the Middle East is the effect it has on oil prices. The 1973 Yom Kippur war, for example, had a profound impact on markets – with an oil embargo causing prices to rise by more than 300%. Inflation soared, and a market downturn followed, leading to a decade of stagnation in markets. We saw another oil price shock in 1990, following Iraq’s invasion of Kuwait. However, as seen in the chart below, recent conflicts between Israel and Palestine have had a limited impact on oil prices and developed markets equities. Barring a major escalation, the risk to oil supply is not severe.

The ongoing conflict between Israel and Palestine

As you can see from the charts above and below, the ongoing conflict between Israel and Palestine has had relatively little effect on oil prices (and so the effects have not spilled over into global financial markets). One reason for this is that the world is quite different now compared to a few decades ago.

Following the 1973 oil embargo, the International Energy Agency was established in 1974 – to respond to future energy supply disruptions; this led to the creation of the US Strategic Petroleum Reserve, which can mitigate temporary supply shocks. The United States now produces more oil than any country at any time in history, meaning that countries are less reliant on middle eastern imports.

What does this mean for your investments?

Recent attacks from Israel and Iran have been contained and the spillover relatively limited. Of course, war is unpredictable and financial markets do not like surprises. From a portfolio construction standpoint, there is little that investors can do besides diversify. Whilst stocks may experience a large sell off, investors may move into safe haven assets such as government bonds and gold, with shares in defence companies also faring well during times of conflict.

Rest assured, your portfolios are very well diversified across regions and asset classes, and the active managers in your portfolios are able to quickly navigate stress situations as they unfold. Overall, we believe your portfolio is robust, and we are comfortable with the exposure and allocations given the ongoing geopolitical tensions.

If you’re interested in hearing more about the impact on your investments, book a meeting with your Financial Adviser - Book a meeting