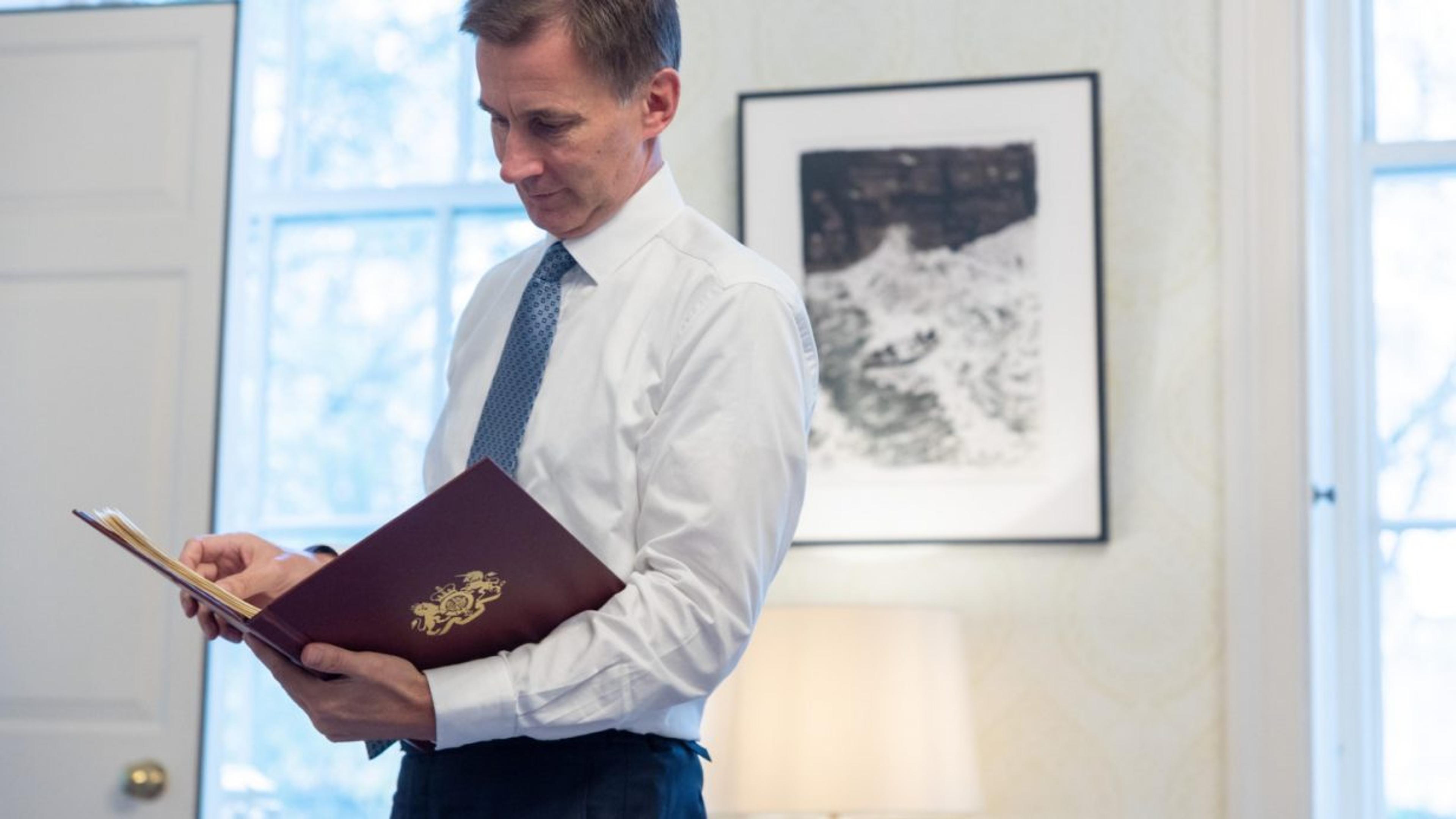

The Chancellor, Jeremy Hunt, delivered his second major fiscal statement today, which included major pension overhauls to encourage highly-skilled workers to remain in the labour market. Here is our summary of some of the key pension changes that may impact you…

Lifetime Allowance

Mr Hunt confirmed that the lifetime allowance - the total amount workers can accumulate in their pension savings before paying extra tax - has been abolished. Since 2006, when the lifetime allowance was introduced, it had risen to a peak of £1.80m before regular cuts down to £1.00m and then incremental rises to the current level of £1.073m where it’d remain up to and including the 2025/26 tax year.

This has now been removed and thus allows significant tax efficient saving to resume for many.

However, it is worth noting that the maximum amount of tax-free cash (without previous transitional protections) you will be able to withdraw remains at £268,275.

Annual Allowance

The annual allowance, which limits the total amount a person can contribute to a pension in one year without paying a tax charge, has been increased by £20,000, from £40,000 to £60,000.

Taper Allowance

The earnings threshold for when your annual allowance starts to taper down and restrict tax efficient pension contributions is increasing from £240,000 to £260,000. The government are also increasing the minimum tapered annual allowance from £4,000 to £10,000.

Money Purchase Annual Allowance (MPAA)

Introduced in 2015 to coincide with pension freedoms, the MPAA limits the amount you can put in your pension once you have started flexibility accessing funds from it. Today, it was announced that this will rise from £4,000 to £10,000.

Overall this is a positive budget for those trying to save efficiently; however as ever, if you want to find out more about any of these or any other policy changes, and how they’d specifically relate to your circumstances, please get in touch with your adviser.